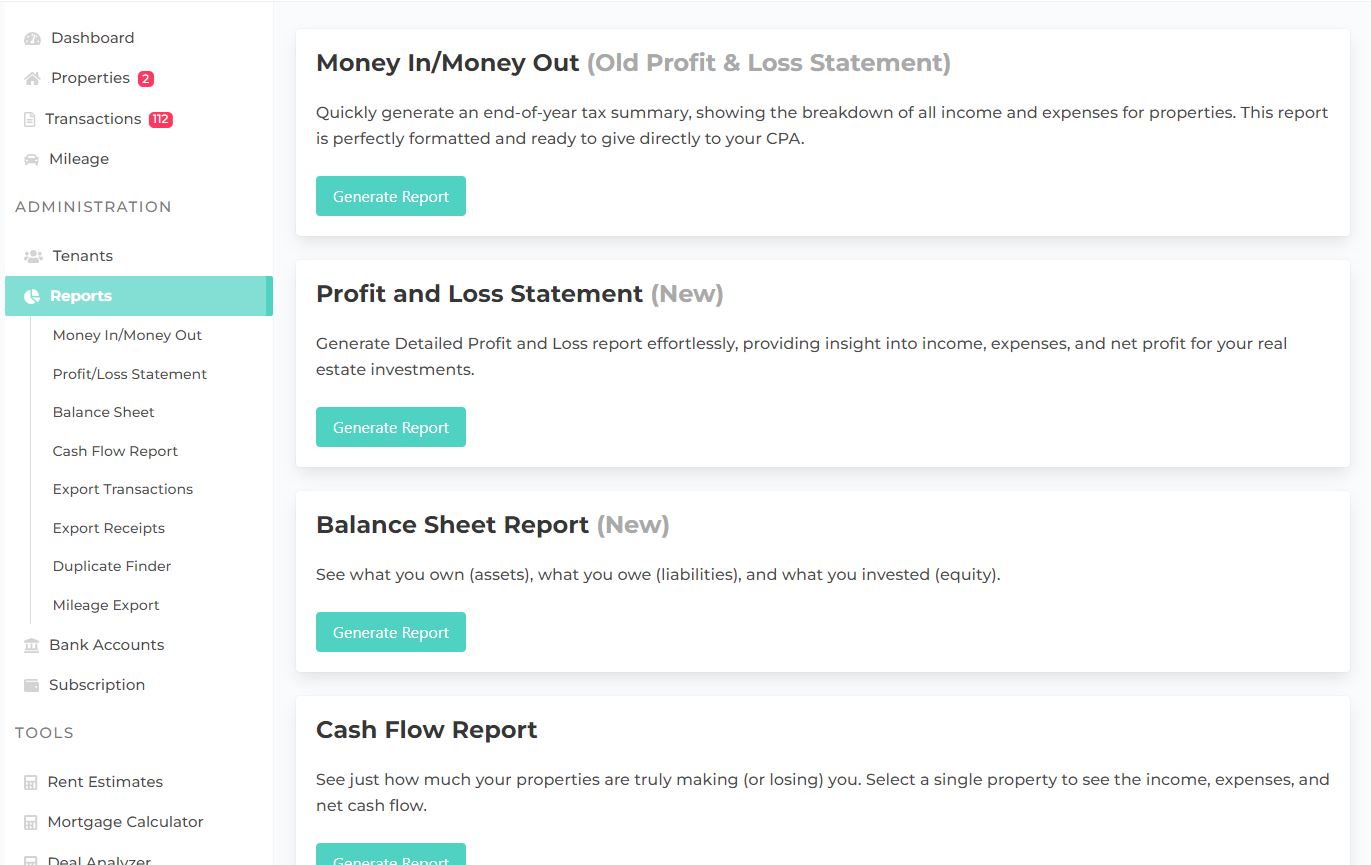

Understanding the Money In/Money Out Report

A Money In/Money Out Report is a critical tool for managing your financial health, especially in real estate investing. This report tracks all cash inflows and outflows, providing you with a clear snapshot of how money is flowing in and out of your business. By regularly reviewing this report, you can better understand your cash flow patterns, identify trends, and make informed financial decisions to optimize your investments.

Why Use a Money In/Money Out Report?

For real estate investors, managing cash flow is crucial. The Money In/Money Out Report helps you:

- Monitor Cash Flow: Keep track of all incoming and outgoing funds to ensure you have sufficient liquidity.

- Identify Trends: Recognize patterns in your income and expenses to make strategic adjustments.

- Optimize Financial Decisions: Use the report to inform budgeting and investment decisions based on your actual cash flow.

Steps to Create a Money In/Money Out Report

- Navigate to the “Reports” Section: Start by logging into your Rentastic account and go to the “Reports” section.

- Select “Money In/Money Out“: Choose the “Money In/Money Out” report option from the available report types.

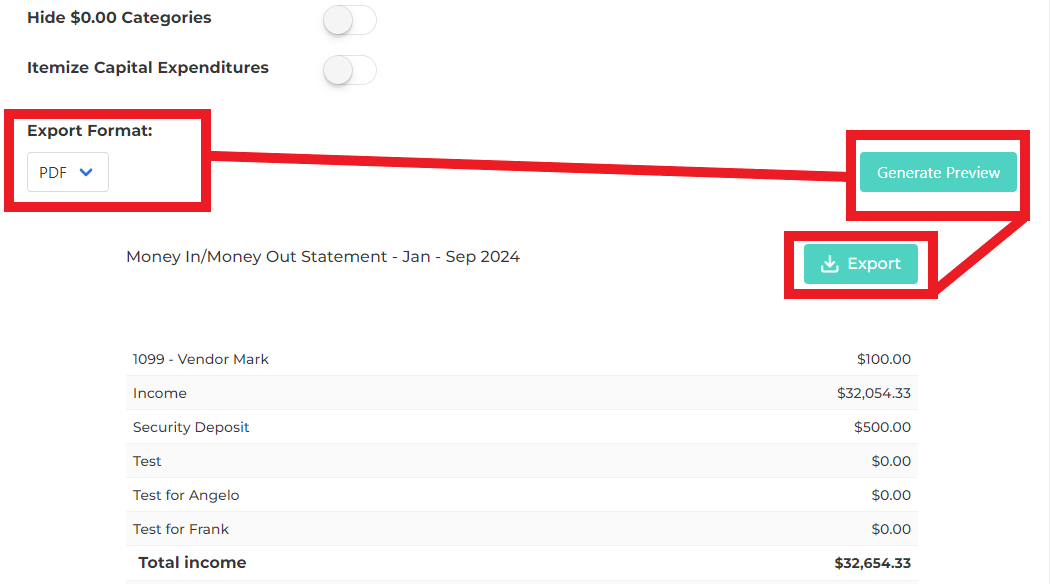

- Customize Your Report: Set the date range for the report and filter by properties or categories as needed to refine your data.

- Click “Generate Report”: Once you’ve set your filters, click the “Generate Report” button located on the bottom of the screen to produce your report.

- Determine Your Export Format: You can decide to export your either as a PDF or CSV file.

- Review Your Report: Examine the detailed breakdown of your cash inflows and outflows to manage your finances more effectively.

By following these steps, you’ll be able to generate a comprehensive Money In/Money Out Report that provides valuable insights into your financial operations.